Activation Fee Waiver Strategy

Turned a recurring revenue + customer trust conflict into a decision system leadership could govern — starting from buyflow behavior, waiver patterns, and operational reality.

Context

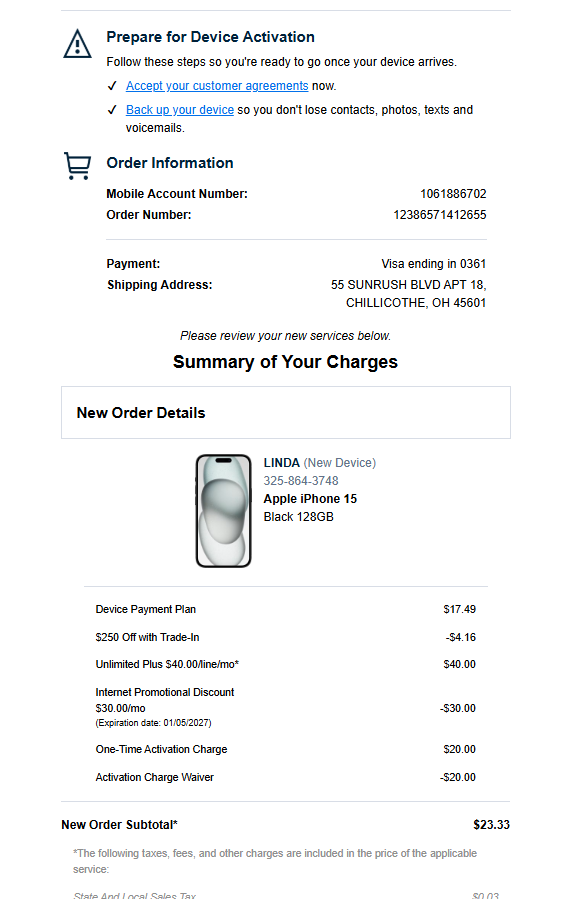

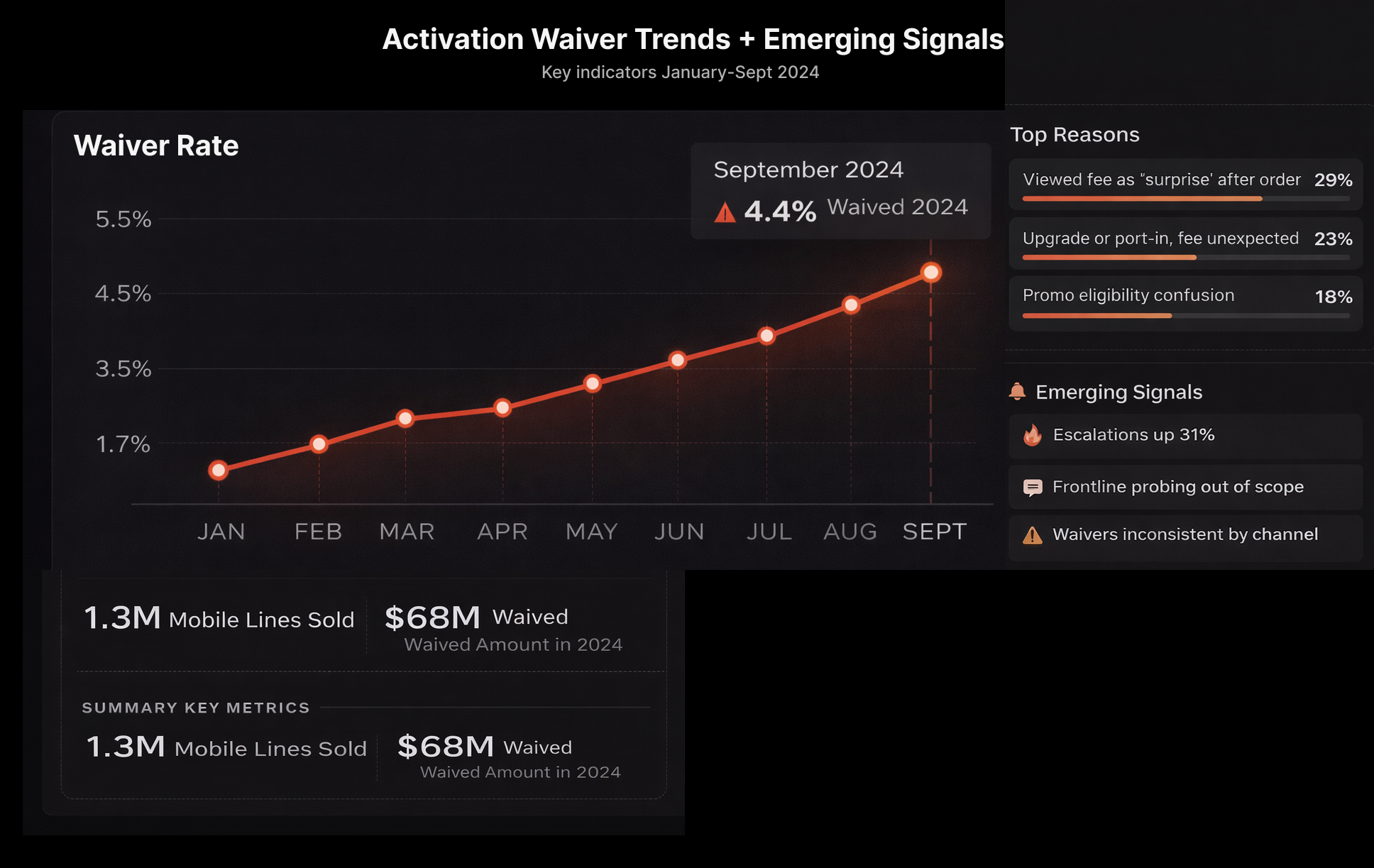

Spectrum Mobile charges a $20 activation fee per line during the buyflow when customers purchase new lines. Over time, the fee became a repeated trigger for customer distrust, escalations, and inconsistent waivers.

Leadership was stuck in a loop: enforce the fee to protect revenue, or waive it to protect satisfaction. That framing was incomplete — it treated waivers like a policy debate, when they were actually a signal of expectation failure.

Problem

Waiver decisions varied across agents and channels. Customers often felt the fee was “added” after their purchase decision, even though it was present in buyflow. This created unnecessary contacts and made waiver spend unpredictable.

- Business: revenue leakage + higher cost-to-serve

- Customer: trust break + “surprise fee” perception

- Ops: agent discretion without guardrails

What I Did

I led a research-only strategy effort to move the conversation from “waive vs enforce” to “what conditions justify a waiver and what conditions demand a system fix.”

Diagnosed the system

Mapped buyflow disclosure moments, downstream contact points, and where expectation gaps formed.

Found repeat patterns

Partnered with CX + frontline to identify waiver clusters and escalation triggers.

Built governance logic

Created a decision framework + experiment plan leaders could operationalize.

Insights

Waivers were driven by expectation gaps, not price sensitivity

Customers were less upset about $20 and more upset about feeling misled. Trust broke when the fee appeared after the customer mentally “completed” their decision.

Frontline teams used waivers as a conflict-resolution tool

When policy was unclear and escalation pressure was high, waiving the fee became the fastest path to resolution — an operational workaround for ambiguity.

Revenue vs CX was a false binary

Inconsistent enforcement damaged both: it leaked revenue and eroded trust. The fix wasn’t “more enforcement” — it was clearer rules + better expectation-setting.

Opportunity Map

I organized opportunities by where they occur in the journey and how directly they reduce distrust and escalation.

Set expectations earlier so customers don’t feel “surprised” at checkout.

- Earlier disclosure placement

- Plain-language fee rationale

- Consistency across channels

Define when waivers protect trust vs when they create moral hazard.

- Clear waiver eligibility

- Reason tagging

- Guardrails by scenario

Reduce first-bill shock and prevent escalations after purchase.

- Proactive confirmation message

- First-bill explainers

- Self-serve routing

Decision Framework

I reframed the question from “Should we waive?” to: “When does a waiver protect long-term value, and when should it trigger a system fix?”

Disclosure issue · System error · Policy exception · Misunderstanding

Tenure/LTV · Channel · Evidence of expectation gap · Severity of friction

When trust protection outweighs revenue risk.

When the fee was clearly disclosed and no failure occurred.

When repeat causes indicate buyflow/policy breakdowns.

Experiment Plan

I defined experiments to reduce waiver volume without harming conversion. The goal was to learn safely and generate evidence leadership could trust.

Impact

This work replaced opinion-driven waiver debate with a governable system: classify → apply guardrails → decide → learn.

Reduced arbitrary waiver behavior and created inputs for scalable automation.

Shifted focus upstream to expectation-setting to prevent trust breaks.

Gave teams consistent guardrails and shared decision language.

Next Steps

If extending into execution, I would embed this framework into governance and product:

- Implement disclosure improvements across channels

- Make waiver reason tagging mandatory for continuous insight

- Roll out rule-based automation for high-confidence scenarios

- Publish a recurring dashboard: waiver drivers + contact volume + conversion